Our Diversity, Equity & Inclusion policy centres around our people. Diversity

and inclusion is about evolving an environment encouraged by respect and

comprehending the differences between us all, whether that be gender, sexual

orientation, race, age or anything else.

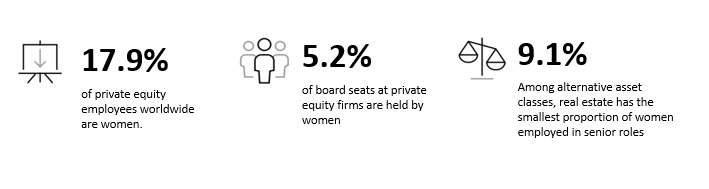

Today’s most difficult challenges come from a diverse, inter connected world; a diverse and well-networked group of professionals have the best chance of responding to such challenges.

Inclusion and diversity are therefore not just a values-based focus, but instead a meaningful investment consideration. At TGIM Assets we continue to translate intent and words into action.

Lack of diversity impedes effective decision making. Having diverse voices is vital to ensure no risks and opportunities are missed. Being exposed to different points of view allows our team to think outside the box and be challenged. Each person in the team brings something different to the table and that contributes to making the right decisions.

Thanks to our diverse talent we are agile and innovative – precisely the attributes needed at a time of disruption. We are firmly believers that retaining a diverse workforce leads to better performancetherefore fully embracing the link between DE&I and performance.

This website uses cookies, including third-party cookies, in order to obtain information about your visit to the website and make this website better. Please click here if you would like more information about the cookies used on this website and how to change your cookie settings. Otherwise, we will assume you're OK to continue.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |